Learn which electrical upgrades qualify for federal tax credits and Illinois rebates while improving your home's safety and energy efficiency.

Share:

Summary:

The federal government is essentially paying you to upgrade your home’s electrical system. Through 2025, homeowners can claim up to $3,200 annually in tax credits for energy-efficient electrical improvements. This isn’t a deduction that reduces your taxable income—it’s a direct credit that reduces what you owe the IRS dollar for dollar.

The program covers electrical panel upgrades, circuit installations, and wiring improvements that support energy-efficient appliances. Your electrical panel must meet National Electric Code standards and have a capacity of 200 amps or more to qualify. The timing works in your favor because you claim the credit for the tax year when the work is completed, not when you purchase the equipment.

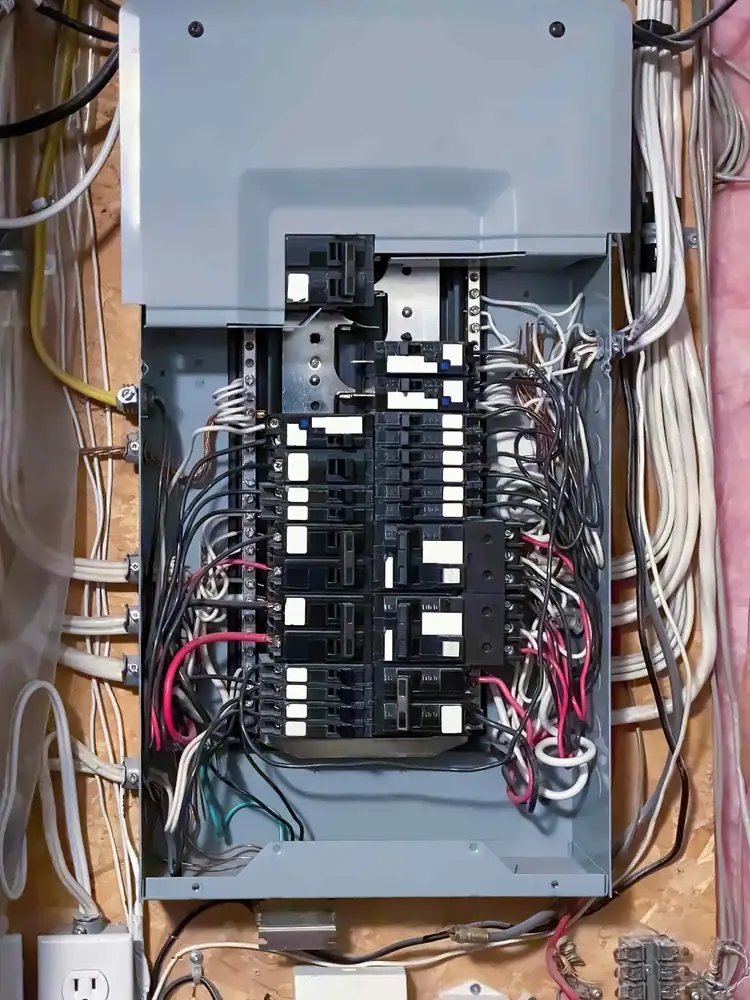

Your electrical panel is the heart of your home’s energy system, and upgrading it unlocks significant savings opportunities. Most homes built before 1990 have panels that can’t efficiently handle today’s energy demands, leading to waste and safety risks. A modern 200-amp panel with smart capabilities can reduce your energy consumption by 10-15% through better load management.

The upgrade becomes even more valuable when you consider future needs. If you’re planning to install an EV charger, heat pump, or solar system, your current panel likely can’t handle the additional load. Rather than paying for multiple electrical visits, a single panel upgrade prepares your home for all these improvements while qualifying for the maximum $600 tax credit.

Cook County and Will County residents face unique considerations due to local electrical codes and utility requirements. ComEd customers can access additional rebates up to $8,000 for electrical infrastructure that supports EV charging. The combination of federal credits and local rebates often covers the entire cost of panel upgrades, making this a no-brainer investment.

Safety considerations make panel upgrades even more compelling. Older panels, especially Federal Pacific and Zinsco brands, are fire hazards that insurance companies increasingly refuse to cover. Upgrading eliminates this risk while positioning your home for decades of efficient energy use.

Your electrical panel is the heart of your home’s energy system, and upgrading it unlocks significant savings opportunities. Most homes built before 1990 have panels that can’t efficiently handle today’s energy demands, leading to waste and safety risks. A modern 200-amp panel with smart capabilities can reduce your energy consumption by 10-15% through better load management.

The upgrade becomes even more valuable when you consider future needs. If you’re planning to install an EV charger, heat pump, or solar system, your current panel likely can’t handle the additional load. Rather than paying for multiple electrical visits, a single panel upgrade prepares your home for all these improvements while qualifying for the maximum $600 tax credit.

Cook County and Will County residents face unique considerations due to local electrical codes and utility requirements. ComEd customers can access additional rebates up to $8,000 for electrical infrastructure that supports EV charging. The combination of federal credits and local rebates often covers the entire cost of panel upgrades, making this a no-brainer investment.

Safety considerations make panel upgrades even more compelling. Older panels, especially Federal Pacific and Zinsco brands, are fire hazards that insurance companies increasingly refuse to cover. Upgrading eliminates this risk while positioning your home for decades of efficient energy use.

Want live answers?

Connect with a Jimco Electric expert for fast, friendly support.

Illinois offers some of the nation’s most generous electrical upgrade incentives, but navigating the programs requires local knowledge. The state’s approach combines utility-specific rebates with income-based programs that can cover entire project costs for qualifying households.

ComEd customers have access to the most comprehensive rebate programs. Their EV Make-Ready program provides up to $8,000 per charger for electrical infrastructure, including panel upgrades, wiring, and installation labor. This program specifically targets the electrical work needed to support EV charging, making it perfect for homeowners planning electric vehicle purchases.

Ameren Illinois customers can access similar programs with slightly different structures. Their rebates focus on energy efficiency improvements that reduce peak demand, offering higher incentives for upgrades completed during off-peak seasons. The timing strategy can increase your rebate by 20-30% compared to peak installation periods.

Illinois’s income-based electrical upgrade programs can cover 50-100% of project costs for qualifying households. The High-Efficiency Electric Homes and Rebates Act allocates $4.5 billion nationally, with Illinois receiving substantial funding for point-of-sale rebates.

Households earning less than 80% of area median income qualify for 100% rebate coverage on electrical upgrades up to $14,000. This includes panel upgrades, circuit additions, and wiring improvements that support energy-efficient appliances. The rebates are applied at the time of purchase, eliminating the need to pay upfront and wait for reimbursement.

Households earning between 80-150% of area median income receive 50% rebate coverage with the same $14,000 maximum. Even partial coverage makes significant electrical improvements affordable for middle-income families. The programs are designed to stack with federal tax credits, creating unprecedented savings opportunities.

Cook County and Will County residents should verify their area median income levels, as they vary by location and household size. Many families earning $80,000-$120,000 annually qualify for substantial rebates, making professional electrical upgrades accessible to working families.

Your utility company determines which rebates you can access, and understanding their specific programs maximizes your savings. ComEd and Ameren Illinois operate different rebate structures with varying application processes and qualification requirements.

ComEd’s programs emphasize electric vehicle infrastructure and demand response capabilities. Their rebates are highest for electrical upgrades that support vehicle-to-grid technology and smart charging systems. Applications require pre-approval and must use certified contractors from their approved installer network.

Ameren’s programs focus on peak demand reduction and energy efficiency. They offer seasonal bonuses for upgrades completed during low-demand periods, typically October through March. Their rebates can be combined with federal tax credits and state programs for maximum savings.

Timing your electrical upgrades strategically can increase total incentives by 25-40%. Federal tax credits must be claimed in the year work is completed, but state rebates often have different deadlines. Planning your upgrades across tax years can maximize the total incentives you receive while spreading the financial impact.

The combination of federal tax credits, state rebates, and utility incentives makes 2025 the ideal time for electrical upgrades in Cook County and Will County. Smart homeowners are taking advantage of these programs to improve safety, reduce energy costs, and prepare for future technology needs.

Start with a professional electrical assessment to identify your home’s specific needs and opportunities. Focus on upgrades that qualify for multiple incentive programs, such as panel upgrades that support EV charging or energy-efficient appliances. The key is maximizing both immediate incentives and long-term energy savings.

For professional electrical upgrade consultation and installation in Cook County and Will County, we have 25 years of experience helping Illinois homeowners navigate incentive programs and complete safe, code-compliant improvements.

Article details:

Share:

Continue learning: